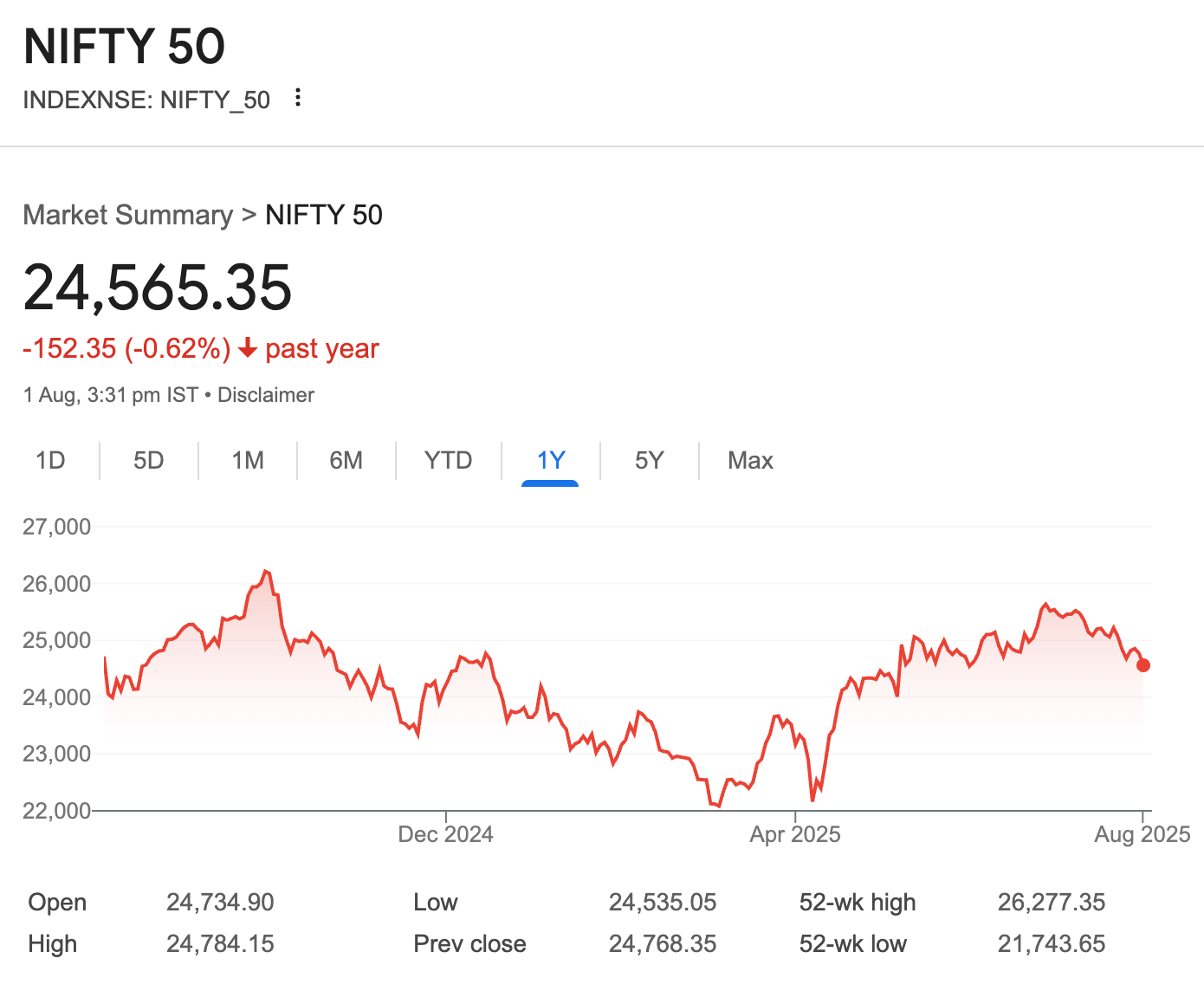

It's been a challenging year for the markets. If you had invested in the NIFTY 50 index a year ago, your portfolio might currently be down by approximately 1%. This is a new experience for many investors who entered the market during the recent bull run. Seeing negative returns can understandably lead to doubts & comparisons and that’s where you should take a step back to think.

Common Investor Reactions |

When markets turn volatile, it's natural to feel anxious. Here are some common reactions we've observed:

· Comparing Returns with FDs: Investors start comparing equity returns with the guaranteed returns of FDs, questioning the risk-reward ratio.

· Considering Stopping SIPs: Some investors consider halting their Systematic Investment Plans (SIPs) to avoid further losses.

· Thinking About Redeeming: The thought of redeeming investments to 'save' what's left of their capital crosses many minds.

· Planning to Exit: Many decide to exit their investments as soon as the portfolio returns to green, vowing to avoid equity markets in the future.

A Look Back: 2022 and Beyond |

It's crucial to remember that market downturns are a part of the investment cycle. Consider the market of 2022. The NIFTY 50 delivered a negative 1-year return of about 6%. Many investors might have panicked and sold their holdings. However, what followed was a strong recovery.

The subsequent year saw a return of approximately 15%. This means that an investor who stayed invested through the downturn achieved a Compound Annual Growth Rate (CAGR) of roughly 20.5% over the two years. Furthermore, the NIFTY 50 has delivered approximately 11% return since 2021, significantly outperforming FDs and debt investments over the same period.

Equity Requires a Long-Term View |

Equity investments are inherently volatile. Short-term market fluctuations are unavoidable. To reap the potential rewards of equity, a long-term investment horizon (typically 3+ years) is essential.

Staying invested, even during market downturns, is often the key to long-term wealth creation. Trying to time the market is notoriously difficult, and often leads to missed opportunities. SIPs are designed to take advantage of volatile markets; by investing at regular intervals you are averaging out the purchase price, and buying more units when the market is low.

We are of the view that the recent measure taken by the Government by offering income tax rebate and RBI’s rate cut will have an impact of consumption over the next 2 quarters. We see recovery of the market in the second half of FY 26.

Do you have any questions about market volatility or your investment strategy? We're here to help you navigate these times.