Investors hear only “Gross Rate of Interest” when it comes to Fixed Deposit.

Example, HDFC Bank is giving 7% Rate of Interest on a 1 year Fixed Deposit.

This looks simple, safe and a good rate of return on a portfolio to an investor.

But generally investors tend to miss these 2 key parameters to judge a Fixed Deposit.

- Tax to be paid on interest (as per income slab)

- Post Inflation net return

Post considering the above parameters, “Net Rate of Return” is determined.

Continuing HDFC Bank’s Fixed deposit example, do you know what is the Net Rate of Return

Gross Rate of Interest (ROI) – 7%

Tax as per income slab – 30% (on ROI)

Average 10 / 15 year inflation has been – 5.17 & 6.83 respectively.

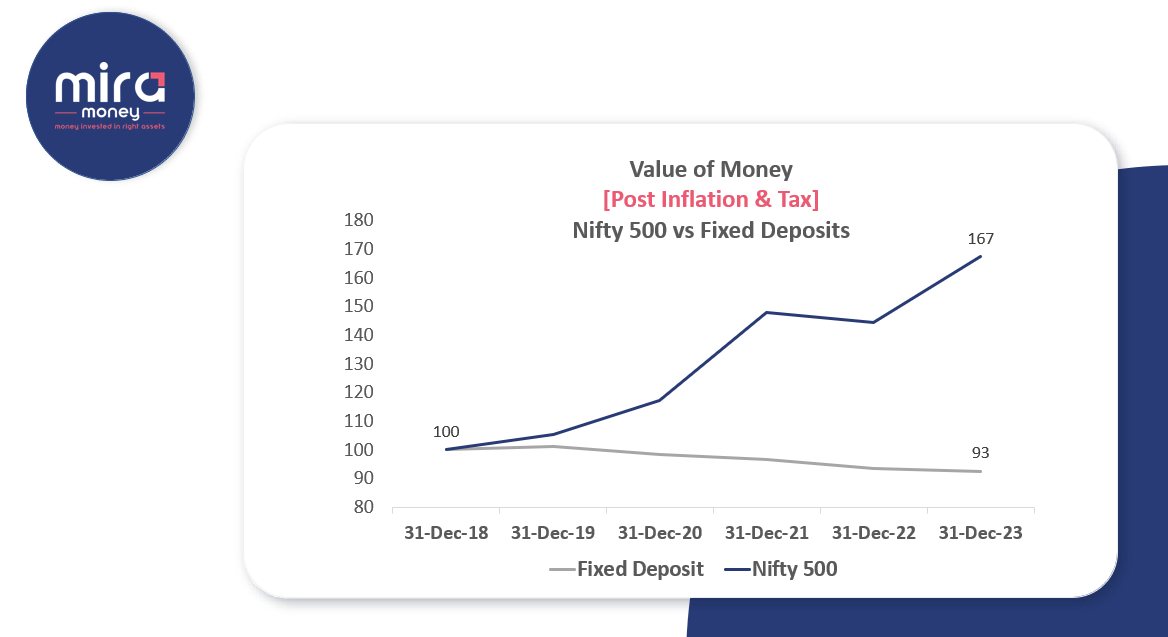

Net Rate of Return – ROI * (1 – Tax) – Average Inflation = Negative 1.1%

In summary, instead of adding value to your money, with Fixed Deposit, you lost 1.1% of your capital after a year.

Always consider Net rate of return, post tax & inflation, to determine the true value of an Asset category like Equity, Gold, Debt, Real Estate, etc.

In conclusion, Fixed Deposit cannot be a major allocation in your portfolio as it will not make your wealth grow. It is good only for short term parking.