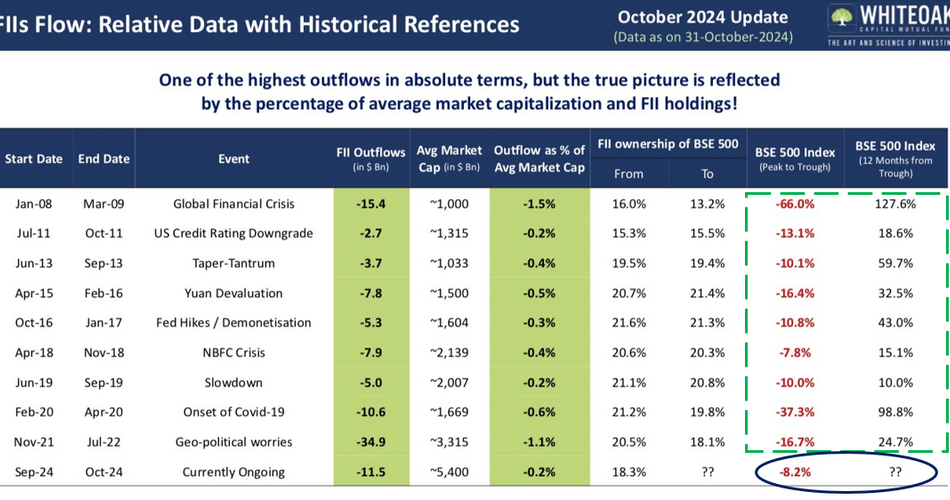

Image depicts the events when FIIs (Foreign Institutional Investors) had sold some of their Indian investments, it had led to a decline in the Indian markets.

This has happened this year too between Sep 24 to Nov24.

However, you should look at the 12 months period post the fall.

Markets have always recovered and most of the time more aggressively.

So, what should you do ?

Make use of your cash available.

Buy on Dips works better as it allows you to invest in the equity markets at lower levels or increase your SIPs.

Be ready to lose 5% on the new money added, in case it happens.

If you are here for a long term wealth creation, then use the opportunity available and accumulate your investments.

Eventually markets will recover, not just because it has done in past, but earnings & growth potential for Corporate India is better than any emerging markets.