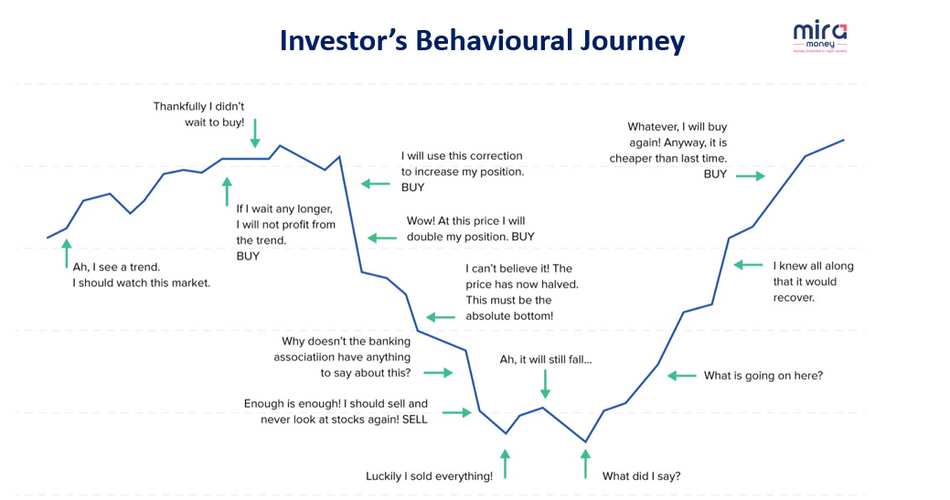

Investors frequently experience, while making an investment decision, the "roller coaster of emotions" as depicted in the image.

It is thereby necessary to understand, and ideally overcome, 𝐜𝐨𝐦𝐦𝐨𝐧 𝐛𝐞𝐡𝐚𝐯𝐢𝐨u𝐫𝐚𝐥 𝐢𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐛𝐢𝐚𝐬𝐞𝐬 that frequently contribute to poor decisions and financial mistakes to be a long-term successful investor.

We have listed below some of the most common behavioural biases an investor goes through in this journey of investing:-

➡𝐋𝐨𝐬𝐬 𝐀𝐯𝐞𝐫𝐬𝐢𝐨𝐧 𝐁𝐢𝐚𝐬 - Loss aversion describes an investor's dislike to selling investments in loss to avoid having to face the fact that they made poor choices. Investors hesitate to sell losing investments in the hopes of recouping their losses end up losing their whole investment in the stock / fund / derivatives.

➡𝐇𝐞𝐫𝐝 𝐁𝐞𝐡𝐚𝐯𝐢𝐨𝐫 𝐁𝐢𝐚𝐬 – When investors follow the herd instead of making their own decisions based on financial data. For example, if all your friends / colleagues are investing in penny stocks, you might consider doing so as well, despite knowing the risk.

➡𝐀𝐧𝐜𝐡𝐨𝐫𝐢𝐧𝐠 𝐁𝐢𝐚𝐬 - People frequently rely too strongly on an initial piece of information when making a purchase or financial decision. It may induce investors to overlook other important factors, resulting in poor investment decisions.

➡𝐂𝐨𝐧𝐟𝐢𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐁𝐢𝐚𝐬 - When investors unconsciously construct arguments or seek evidence that confirms their preconceived notions about a certain investing opportunity. Investors tend to reject opposing viewpoints and the hazards connected with such skewed investments are frequently overlooked.

➡𝐅𝐚𝐦𝐢𝐥𝐢𝐚𝐫𝐢𝐭𝐲 𝐁𝐢𝐚𝐬 - This happens when investors favor familiar or well-known investments, despite the apparent benefits of diversification. This can result in poor portfolios that are more likely to lose money & sometimes not beat benchmarks or even inflation.

Many investors, whether consciously or unconsciously, react emotionally when making investing decisions and may have one or more of the biases listed above.

So what should one do in general ?

💡 Make sure you are not influenced by any of these investing biases before making your investment decisions.

💡 Have full grasp of your risk appetite & the purpose of each investment in your portfolio.

💡 Top-down or Bottom-up approach to identify fund(s)/stock(s)

💡 Spend more time on asset allocation

💡 Do timely monitoring & rebalancing

𝐓𝐡𝐨𝐮𝐠𝐡𝐭 𝐟𝐫𝐨𝐦 𝐌𝐫. 𝐏𝐞𝐭𝐞𝐫 𝐋𝐲𝐧𝐜𝐡 (𝐕𝐞𝐭𝐞𝐫𝐚𝐧 𝐅𝐮𝐧𝐝 𝐌𝐚𝐧𝐚𝐠𝐞𝐫– 𝐅𝐢𝐝𝐞𝐥𝐢𝐭𝐲 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭𝐬) 𝐰𝐨𝐫𝐭𝐡 𝐭𝐡𝐢𝐧𝐤𝐢𝐧𝐠 𝐚𝐛𝐨𝐮𝐭 – “The trick is not to learn to trust your gut feelings..but rather to discipline yourself to ignore them. Stand by your investments as long as the fundamental story of the Company hasn’t changed.”