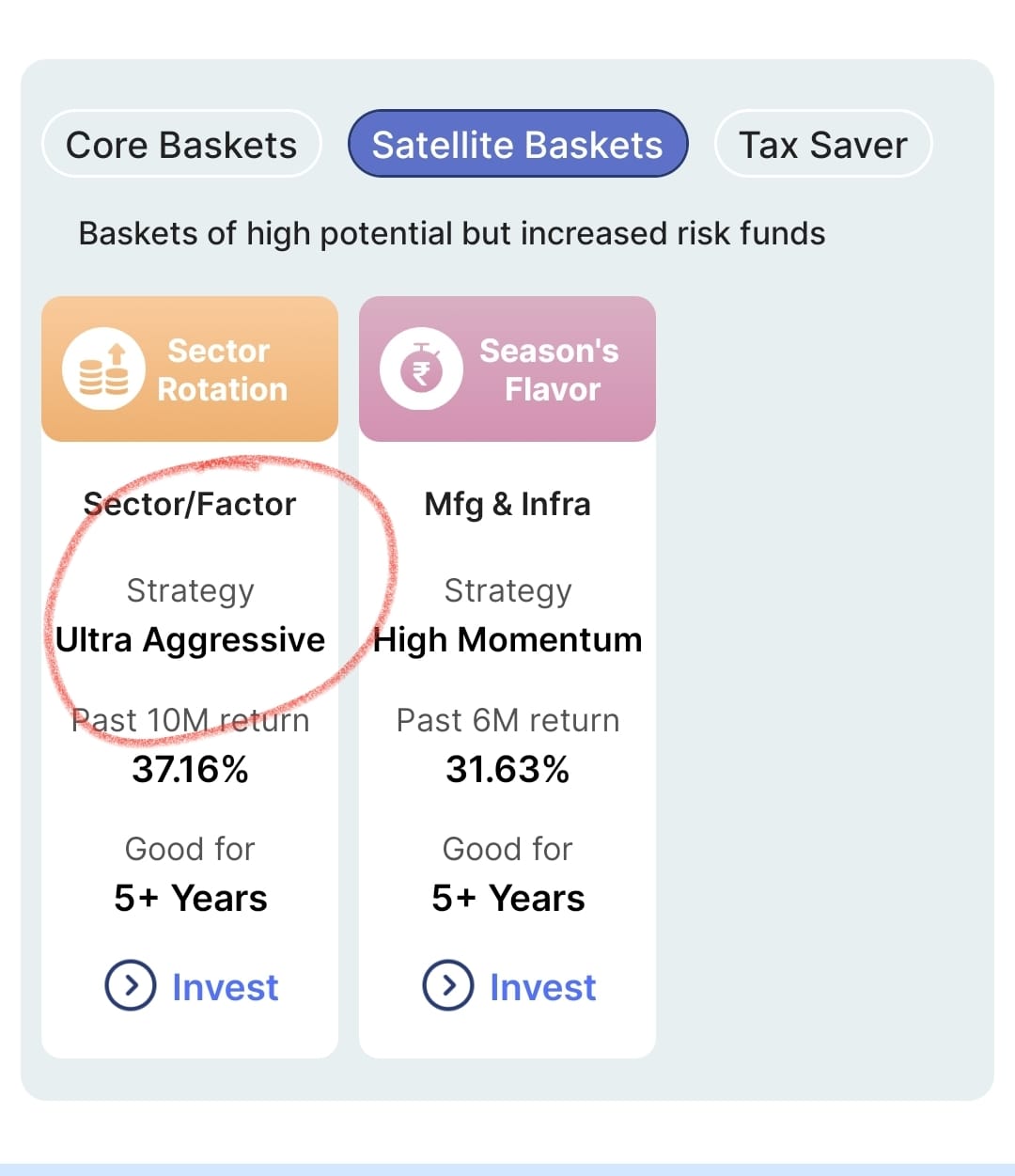

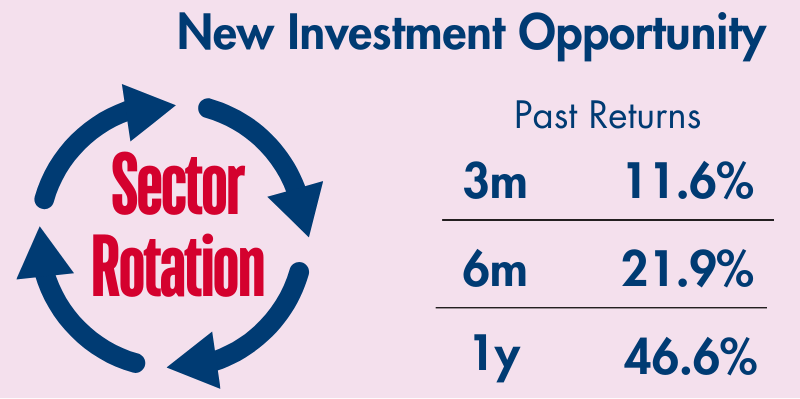

An ultra aggressive investment strategy basket of 3 select sectors & 1 momentum theme funds curated by our investment team is available now in the app for investing.

Manufacturing Sector

Government focus in the manufacturing space has increased and they plan to improve the manufacturing’s GDP share from 14% to 20% in the next few years. Manufacturing theme has a wide range of sub segments like construction, capital goods, auto, pharma, defence, cement and materials segments.

Pharma & Healthcare Sector

As of 2024, the Indian pharmaceutical market is valued at USD 65 billion and is projected to skyrocket to $130 billion by 2030. Beyond just keeping up with the demand at home, the Indian pharma industry commands over 20% of the global pharma supply chain and addresses approximately 60% of the worldwide demand for vaccines.

Banking & Financial Services Sector

India is leading the charge. Cloud-based solutions are the backbone of modern BFSI operations. Indian SaaS companies are developing cutting-edge solutions in areas like core banking, wealth management, and risk management, all at a fraction of the cost of traditional on-premise systems.

Momentum Theme

This thematic fund builds a portfolio of stocks which are trending upwards with less volatility.