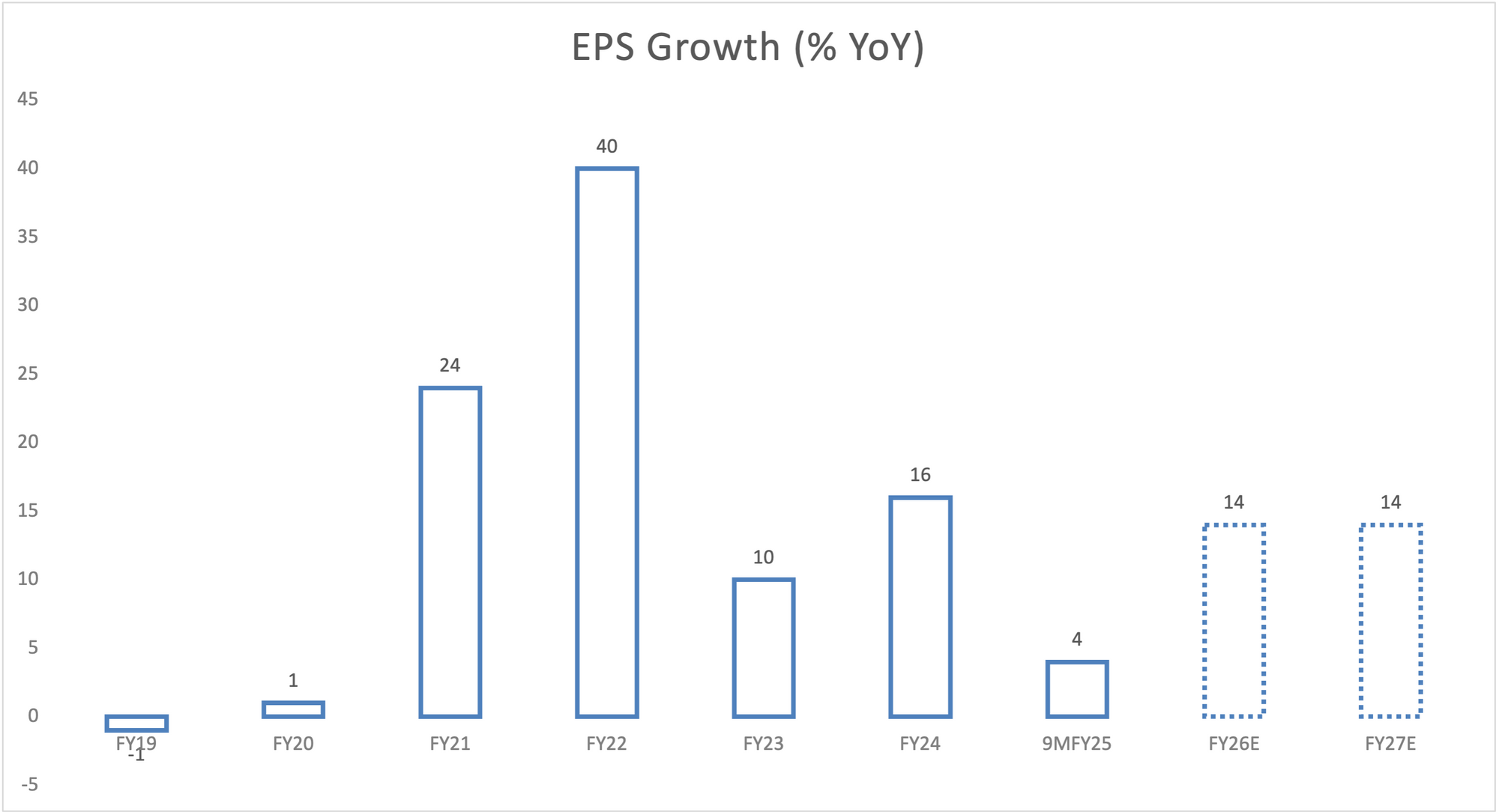

Indian markets went on a dream run post covid.

Thanks to the unprecedented earnings growth between FY 21- 24.

Then came the sudden break in the form of slowdown in earnings (4%).

Indian market corrected due to earnings not growing as per expectations and fall in valuations (p/e) due to poor performance.

Why will any investor, whether FII or DII, pay a high price to an asset that generates low returns? Simple right?

But lots of investor now ask, “will the markets ever turn back up?”

Yes, IT WILL.

India is currently going through a cyclical slowdown which may last another quarter. Government & RBI have taken the right steps in the recent days after identifying the mistakes. There is no way that earnings will not come back. Once it does, market will start looking up.

What should you do with your money?

If already invested, hold tight.

If you are doing SIP, increase.

If you have some new lumpsum, stagger it over the next 100 days.

Let’s be fully invested before June 2025.